| Previous Top Next |

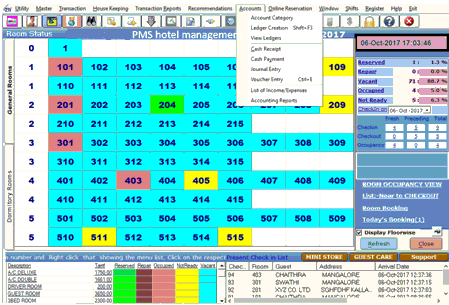

ACCOUNTS

Hotel accounting is not simply about managing revenue and expenses. Independent hotels and hotel franchises have unique financial needs that demand competent staff and an accounting system that will allow management to plan for the future and improve services for both guests and staff alike.

Capital Account

The capital account is one of two primary components of the balance of payments, the other being the current account. Whereas the current account reflects a nation's net income, the capital account reflects net change in ownership of national assets

Reserves and Surplus [Retained Earnings]

Reserves are the funds earmarked for a specific purpose, which the company intends to use in future. Surplus is where the profits of the company reside. Open ledgers like Capital Reserve, General Reserve, and Reserve for Depreciation, etc.

Current Assets

Directly under Current Assets, you may find place for assets that do not fall under the following sub-groups:

Bank Accounts

A bank account can be a deposit account, a credit card account, a current account, or any other type of account offered by a financial institution, and represents the funds that a customer has entrusted to the financial institution and from which the customer can make withdrawals

Cash-in hand

Payment for goods and services in cash rather than by cheque or other means, typically as a way of avoiding the payment of tax on the amount earned.

Note: An account under Cash-in-hand group or Bank Accounts/Bank OCC A/c group is printed as separate Cash Book in the traditional Cash Book format and does not form part of the Ledger.

Deposits (Asset)

In essence, a place for Fixed Deposits, Security Deposits, or any deposit made by the company (not received by the company, which is a liability).

Loans & Advances (Asset)

For all loans given by the company and advances of a non-trading nature, e.g., advance against salaries, or even for purchase of Fixed Assets. We do not recommend you to open Advances to Suppliers account under this group. Doing so gives rise to the difficulty in ascertaining advance position of a particular supplier and to adjust future bills against such advances. For further details, please refer to the section on Common Errors.

Stock-in-hand

This is a special group. You may wish to open accounts like Raw Materials, Work-in-Progress and Finished Goods. How the balances are controlled depends on whether you opted to maintain an integrated account-cum-inventory system in the company features. (Refer to company creation section for more details) Let's consider the options:

Integrated Accounts-cum-Inventory

You are allowed transactions in Inventory records and the account balances are automatically reflected in the Balance Sheet as Closing Stock. You are not allowed to directly change the closing balance of an account under this group.

Non-integrated Accounts-cum-Inventory

Accounts that fall under this group are not permitted any transactions. It allows you to hold opening and closing balances only. Since no vouchers can be passed for these accounts, they are the only accounts for which the closing balances can be directly altered (by an authorised user only)

Sundry Debtors

Sundry debtors might refer to a company's customers who rarely make purchases on credit and the amounts they purchase are not significant. For more information on common and possible errors in grouping of accounts, please refer below to the separate paragraph on the topic.

Current Liabilities

You may open accounts like Outstanding Liabilities, Statutory Liabilities and other minor liabilities directly under this group. Sub-groups under Current Liabilities are Duties and Taxes, Provisions and Sundry Creditors

Duties and Taxes

For all tax accounts like VAT, MODVAT, Excise, Sales and other trade taxes. A convenient place to find the total liability (or asset in case of advances paid), as well as the break-up of individual items.

Provisions

A provision is an amount that you put in aside in your accounts to cover a future liability. The purpose of a provision is to make a current year's balance more accurate, as there may be costs which could, to some extent, be accounted for in either the current or previous financial year. Provision accounts like Provision for Taxation, Provision for Depreciation, etc.

Sundry Creditors

For trade creditors of the company do not open your supplier accounts under the Purchases Account group, which is a revenue account. For more information on common and possible errors in grouping of accounts, please refer below to the separate paragraph on the topic.

Investments

An investment is the purchase of goods that are not consumed today but are used in the future to create wealth. In finance, an investment is a monetary asset purchased with the idea that the asset will provide income in the future or will be sold at a higher price for a profit.

Loans (Liability)

A loan is an arrangement under which a lender allows another party the use of funds in exchange for an interest payment and the return of the funds at the end of the lending arrangement.

Bank OD Accounts [Bank OCC Accounts]

Accounts gives two distinct types of Bank Accounts, The Bank OCC A/c is meant to record the company's overdraft accounts with banks. e.g., Bill Discounted A/c, Hypothecation A/c etc.

Note: An account under Bank OCC A/c group is printed as separate Cash Book in the traditional Cash Book format and does not form part of the Ledger.

Secured Loans

For term loans and other long/medium term loans that have been obtained against security of some asset. Tally does not verify the existence of the security. Typical accounts would be Debentures, Term Loans, etc.

Unsecured Loans

For loans obtained without any security .e.g., Loans from Directors/partners or outside parties.

Suspense Account

Theoretically speaking, this group should not exist. However, in modern accounting, many large corporations use a Suspense Ledger to track moneys paid or recovered, the nature of which is not yet known. The most common example is money paid for Traveling Advance whose details would be known only upon submission of the TA bill. Some companies may prefer to open such accounts under

Loans and Advances (Asset) group.

Please note that Suspense Account is a Balance Sheet item. Any expense account even if it has 'suspense' in its name, should be opened under a Revenue group like Indirect Expenses and not under Suspense Account group.

Miscellaneous Expenses (Asset)

This group is typically used more for legal disclosure requirements, like Schedule VI of the Indian Companies Act. It should hold incorporation and pre-operative expenses. Companies would write off a permissible portion of the account every year. A balance would remain to the extent not written off in Profit & Loss Account. Accounts do not, however, show a loss, carried forward in the profit and loss accounts, under this group. The Profit & Loss Account balance is shown separately in the balance sheet.

Branch/Divisions

This group is provided to keep the ledger accounts of all companies that are your company's branches, divisions, affiliates, sister concerns, subsidiaries, etc. This is a group of convenience. You may not wish to utilize it in this manner. Note that Accounts permits Sales and Purchase transactions to take place with accounts opened here. Remember, these are their accounts in your books and not their books of accounts. Just treat them as you would any party account. If you wish to maintain the books of that branch/division on your computer, you must open a separate company. (Accounts allow maintenance of multiple company accounts).

Revenue Primary Groups

Sales Account

For different sales accounts, the natural segregation of your sales accounts could be based on Tax slabs or type of sales. This also becomes a simple mechanism for preparation of Tax returns.

Purchase Account

This is similar to sales accounts, except for the purpose of the transaction. The account Purchases is generally associated with the purchase of inventory items under the periodic inventory system. Under the periodic system the account Inventory is dormant until it is adjusted to the cost of the ending inventory at the end of an accounting period.

Direct Income [Income Direct]

For non-trade income accounts that affect Gross Profit. All trade income accounts would naturally fall under Sales Accounts. You may wish to use this group for accounts like Servicing Contract Charges that follow sales of equipment.

If yours is a professional services company, you may not use the Sales Account group at all. Instead, open accounts like Professional Fees under this group.

Indirect Income [Income Indirect]

The extra income earned

may or may not belong to any business activity. E.g. interest received

on a

fixed deposit of capital, receiving discount etc. indirect income is the income which

is indirectly

earned may be received in the form of lotteries.

Direct Expenses [Expenses Direct]

The income or expenses which direct relates to the manufacturing/production of your business are known as direct expenses. Direct expenses are relating to production and purchasing of goods. All expenses which are incurred for production or purchasing are called direct expenses.

Indirect Expenses [Expenses Indirect]

Indirect expenses are those expenses that are incurred to operate a business as a whole or a segment of a business, and so cannot be directly associated with a cost object, such as a product, service, or customer. A cost object is any item for which you are separately measuring costs.

Accounts automatically open the Profit & Loss Account which is a reserved primary account. You may use this account to pass adjustment entries through journal vouchers .e.g., transfer of profit or loss to Capital or Reserve account.